Foreign exchange, or Forex (FX) trading, is a dynamic and global financial market where currencies are bought and sold. It's the largest and most liquid market globally, with a daily trading volume that exceeds $6 trillion. In this comprehensive guide, we will explore what Forex trading is, how it works, the key participants, trading strategies, and its significance in the global financial landscape.

Understanding Forex Trading

What is Forex (FX) Trading?

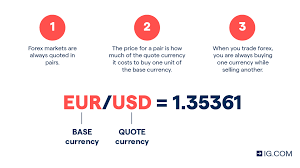

Forex trading involves the simultaneous buying of one currency and selling of another. These transactions occur in currency pairs, where one currency is exchanged for another. For instance, in the EUR/USD currency pair, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

The Forex Market Structure

The Forex market is decentralized, meaning it does not have a central exchange. Instead, it consists of a network of interconnected banks, financial institutions, corporations, governments, and individual traders who engage in currency trading. This decentralization allows the Forex market to operate 24 hours a day, five days a week, across different time zones.

How Does Forex Trading Work?

Currency Pairs and Quotes

Currency pairs are categorized into three groups: majors, minors, and exotics. Majors involve the most traded currencies globally, minors include currencies from smaller economies, and exotics comprise less commonly traded currencies.

Exchange rates are quoted in pairs, and there are two prices: the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy a currency pair). The difference between these two prices is known as the spread.

Market Participants

Several key participants play essential roles in the Forex market:

Retail Traders: Individual traders like you and me who speculate on currency price movements through online Forex brokers.

Banks: Major banks facilitate currency transactions for clients and themselves, often serving as market makers.

Central Banks: They influence their respective currencies' value through monetary policies, such as interest rate adjustments.

Corporations: Multinational corporations use Forex markets to hedge against currency risk when conducting international business transactions.

Leverage and Margin

Leverage is a significant aspect of Forex trading, allowing traders to control larger positions with a relatively small amount of capital. While leverage can magnify profits, it also increases potential losses, making risk management crucial. Traders use margin accounts to access leverage, but it's essential to understand the associated risks.

Getting Started in Forex Trading

Choosing a Forex Broker

Selecting a reputable Forex broker is a critical first step. Consider factors such as regulatory compliance, spreads, available trading platforms, and customer support when making your choice.

Opening a Trading Account

After choosing a broker, you'll need to open a trading account. Brokers offer various account types, including standard, mini, and micro accounts, catering to different capital levels and risk tolerances.

Market Analysis

Before executing trades, traders must analyze the market. Two primary methods are used for analysis:

Technical Analysis: This involves studying historical price charts, patterns, and technical indicators to predict future price movements.

Fundamental Analysis: This approach focuses on economic and geopolitical factors affecting currency values, such as interest rates, economic data, and political stability.

Trading Strategies

Various trading strategies are employed in the Forex market:

Day Trading: Involves opening and closing positions within the same trading day to profit from short-term price fluctuations.

Swing Trading: Requires holding positions for several days or weeks to capitalize on intermediate-term trends.

Scalping: Involves making quick, small trades to profit from minimal price movements.

Position Trading: Requires holding positions for an extended period, often months or years, based on long-term trends.

Advantages of Forex Trading

High Liquidity

Forex markets offer high liquidity, allowing traders to enter and exit positions with minimal price slippage.

Accessibility

Forex trading is accessible to anyone with an internet connection and a small initial investment. Many brokers offer demo accounts for practice.

Leverage

Leverage allows traders to control larger positions with a relatively small amount of capital. While it magnifies profits, it also increases potential losses, so use it cautiously.

Diverse Trading Hours

Forex markets are open 24/5, allowing traders to choose the most convenient times to trade.

Risks of Forex Trading

High Volatility

The forex market's high liquidity can lead to rapid and unpredictable price movements, increasing the risk of substantial losses.

Leverage

While leverage can amplify profits, it also multiplies losses. Novice traders should use low leverage or none at all.

Psychological Challenges

Emotional discipline is essential in forex trading. Fear and greed can lead to impulsive decisions that result in losses.

Conclusion

Forex trading offers immense opportunities for those willing to learn and apply the right strategies. As a beginner, it's vital to gain a solid understanding of the market, choose a reputable broker, develop a trading plan, and practice disciplined risk management. While there are inherent risks involved, with the right knowledge and experience, forex trading can become a rewarding and potentially profitable venture. Start your journey with caution, and over time, you can become a proficient forex trader in this dynamic and exciting financial market.