Forex trading, also known as foreign exchange trading, has gained significant popularity in Kenya over the years. Many Kenyans are drawn to the Forex market as a potential avenue for financial gain and investment. However, the legality of online Forex trading in Kenya has been a subject of debate and confusion. In this comprehensive article, we will explore the legal framework surrounding Forex trading in Kenya, the role of regulatory authorities, and the implications for traders and brokers.

Understanding Forex Trading

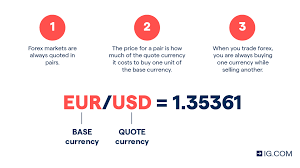

Forex trading involves the buying and selling of currencies on the foreign exchange market. Traders aim to profit from the fluctuations in currency exchange rates. This global market operates 24 hours a day, five days a week, and is one of the largest and most liquid financial markets in the world.

The Legal Framework for Forex Trading in Kenya

The legality of online Forex trading in Kenya is primarily governed by the Capital Markets Authority (CMA), which is the regulatory body responsible for overseeing the financial markets in the country. The CMA has established guidelines and regulations to ensure the transparency and integrity of financial transactions, including those related to Forex trading.

1. CMA Regulations:

The Capital Markets Authority Act (Cap 485A) empowers the CMA to regulate all capital market intermediaries, including Forex brokers operating in Kenya. The CMA issued regulations in 2017 that specifically address online Forex trading. These regulations set out the requirements for Forex brokers, including minimum capital requirements and compliance with anti-money laundering (AML) and know your customer (KYC) procedures.

2. Licensed Forex Brokers:

To operate legally in Kenya, Forex brokers must obtain a license from the CMA. Licensed brokers are required to adhere to strict regulatory standards, which are designed to protect the interests of traders and maintain the integrity of the Forex market.

3. Investor Protection:

The CMA regulations also include measures aimed at protecting investors. Licensed brokers must provide clear and accurate information to clients, and they are subject to regular audits and oversight by the CMA.

4. Offshore Broker Restrictions:

The CMA has issued warnings against Kenyan citizens engaging with offshore Forex brokers that are not licensed by the authority. Trading with unregulated brokers may expose traders to risks, including potential fraud.

Challenges and Controversies

Despite the regulatory framework put in place by the CMA, there have been challenges and controversies related to Forex trading in Kenya:

1. Lack of Clarity:

Some traders and investors have voiced concerns about the lack of clarity in the regulatory environment. They argue that the regulations have not been consistently enforced and that there is a need for greater transparency.

2. Offshore Brokers:

Many Kenyan traders continue to engage with offshore Forex brokers that are not licensed by the CMA. While the CMA has issued warnings against this practice, it remains a common practice among traders seeking higher leverage and more flexible trading conditions.

3. Fraud and Scams:

The online nature of Forex trading has also made it susceptible to fraud and scams. Some unregulated brokers and individuals have taken advantage of unsuspecting traders, leading to financial losses.

Conclusion: The Legal Landscape of Forex Trading in Kenya

In conclusion, online Forex trading is legal in Kenya, but it is subject to strict regulation by the Capital Markets Authority (CMA). Licensed Forex brokers must comply with the regulations set forth by the CMA to operate legally within the country. However, challenges and controversies persist, including the engagement of Kenyan traders with offshore brokers and concerns about regulatory enforcement and transparency.

As a trader in Kenya, it is essential to conduct due diligence when choosing a Forex broker. Ensure that the broker is licensed by the CMA and operates in compliance with Kenyan regulations. Additionally, traders should exercise caution when engaging with offshore brokers to mitigate the risks associated with unregulated entities.

While online Forex trading offers opportunities for financial growth and investment, it is crucial to prioritize security, regulatory compliance, and responsible trading practices to navigate the dynamic world of Forex trading successfully in Kenya.